International shipping is a major – and rapidly growing – source of greenhouse gas emissions. Agreement to apply a carbon price to shipping can both reduce emissions and raise funds for climate change adaptation and mitigation in developing countries. This paper shows that doing so is possible while ensuring developing countries face no net costs. COP17 in Durban, South Africa, at the end of 2011 provides an opportunity to agree on the key principles of such a deal.

International shipping and the twin challenges post-Cancun

At the most recent UN Climate Change Conference in Cancun, Mexico, in December 2010, governments saved the global climate negotiations from collapse. But they did not solve the climate crisis.

Two challenges loom especially large post-Cancun. First, governments must close the gap between the cuts to greenhouse gas emissions pledged so far and those needed to avoid catastrophic climate change. Second, rich country governments must mobilize the money needed to fill the Green Climate Fund (GCF) established in Cancun.

The climate security of the whole world depends on the urgency with which these twin challenges are confronted. In 2011 a deal to control rising emissions from international shipping could help tackle both.

Shipping emissions – or ‘bunkers’ in the jargon of the UN climate negotiations (bunker fuel is the name of fuel oil used in ships) – are large and growing fast. A single ship can emit more in one year than many small island states. Yet, they are not currently regulated under the global climate regime.

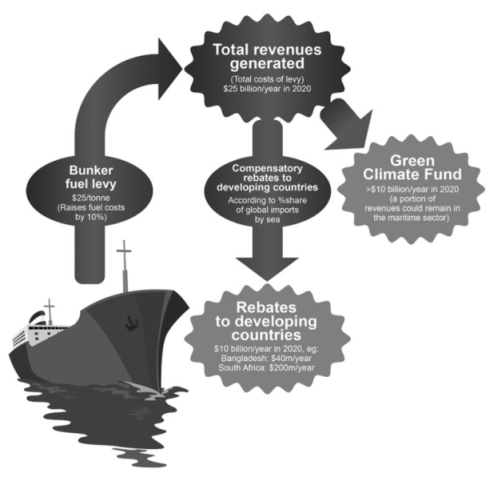

This paper shows that setting a carbon price for ships, at around $25 per tonne, can drive significant maritime emissions cuts. That is likely to increase the cost of shipping by just 0.2 per cent, or $2 for every $1,000 traded, but would raise $25 billion per year. That money should be used to ensure that developing countries face no net costs as a result – since developed countries must lead the fight against climate change – and to provide major new resources for the GCF.

Close the emissions gap

Pledges of emissions cuts were made in Cancun by an unprecedented range of countries, and for the first time developing countries pledged greater cuts than developed countries compared with ‘business as usual’. Still, their combined efforts will leave emissions in 2020 about 5″9 giga tonnes above where they should be if the chance of limiting global temperature rise to 1.5 °C is to be kept within reach.

By the next climate change conference, COP17, in Durban in November/December 2011, governments must agree upon concrete measures to close this gap. They can increase their pledges so that each country does its fair share, close loopholes in technical accounting rules, and bring new sources of emissions into the global mitigation effort.

International shipping is already responsible for around three per cent of global emissions, equivalent to those of Germany. These emissions are projected to increase by 150″250 per cent by 2050 (IMO [2009] ‘Second IMO GHG Study 2009’), but are as yet unregulated. Tough action on emissions from ships will mark a major step towards closing the emissions gap.

Fill the fund

The right institutions are vital if finance for adaptation to climate change and reduction of emissions in developing countries is to reach those who need it most and can spend it best. The establishment of the GCF in Cancun gives hope that past failings will be put right.

However, the fund will be an empty shell without a reliable flow of new revenues. In Cancun, rich countries again committed $100 billion per year by 2020, but again failed to say concretely where this would come from.

By COP17 in Durban, governments must agree to a trajectory of scaled-up climate finance from 2013 to 2020. Pricing emissions from ships, either through a fuel levy or by auctioning emissions allowances, could generate billions of dollars. At $25 per tonne of CO2, this could raise around $25 billion per year by 2020, of which at least $10 billion should be directed to the Green Climate Fund.

Guiding principles for a fair global deal on shipping emissions

Efforts to control rapidly rising emissions from ships have been caught for over a decade between the rock of the International Maritime Organization (IMO – the UN agency with authority for regulating international shipping) and the hard place of the UN Framework Convention on Climate Change (UNFCCC).

Developed countries argue that all ships must be covered by the same regulation, the norm in the IMO. Most developing countries insist that any regulation respects the principle that developed countries must lead the fight against climate change, known in the UNFCCC as ‘common but differentiated responsibilities’ (CBDR).

Only a global approach that does not unfairly impact on developing countries can break this impasse. In 2011, governments must agree to three core principles of such a scheme.

1. Meaningful emissions reductions: A carbon price should be set for emissions from all ships to ensure emissions cuts from that sector that are in line with the goal of keeping global warming below 1.5 °C.

2. No net costs for developing countries: Because shipping emissions cannot practically be attributed to individual countries, a carbon price for ships must be universal. But to ensure that it is fully consistent with the CBDR principle, such a scheme must guarantee that there are no net costs for developing countries. Part of the revenues generated should therefore be used to provide rebates to developing countries to compensate for the impacts on their economies.

3. Substantial revenues for the Green Climate Fund: The major share of remaining revenues should be directed to the Green Climate Fund as a continuous source of new and reliable revenues for adaptation and mitigation efforts in developing countries.

Figure 1: Potential scale of revenues from a carbon price for shipping

Source: Oxfam and WWF analysis

After more than a decade of delay, a breakthrough agreement can be struck in 2011. A proposal for a fair deal on a global carbon price – using revenues to compensate developing countries and as climate finance – is on the table in the IMO and entering discussions under the UNFCCC. A first step was taken in July 2011 when efficiency standards for new ships were adopted in the IMO. Although this will barely alter the projected rise in shipping emissions over the next decade,it was a useful first step that opens the way for a fair deal on a carbon price for ships that will drive emissions reductions at the scale needed.

Champions for such a deal are emerging. As G20 chair, France has made innovative financing for climate change and development a high priority for the summit in Cannes in November 2011 on the eve of the Durban COP. France and Germany both called this July for revenues from a carbon price for ships to be used to compensate developing countries and as climate finance. The EU already backs a carbon price with revenues used as climate finance, and will consider its common position on using some revenues to compensate developing countries at the October 2011 meeting of EU finance ministers.

The Group of Least Developed Countries has long called for climate finance to be raised from international transport, and many Small Island Developing States have called for emissions from shipping to be urgently tackled. Mexico, which has the G20 chair after France, has also heavily invested in making the Green Climate Fund a success, having driven for its establishment in Cancun. Unlike some of their counterparts in aviation, many players in the shipping industry are calling for a carbon price to be set.

High and rising emissions from ships

|

Principle 1: Meaningful mitigation

The fact that shipping is more efficient than other forms of transport (in terms of emissions per tonne-kilometre of goods transported), or claims by industry that the efficiency per unit shipped is improving, must not distract attention from the sheer scale of shipping emissions and their frightening rate of growth. If global warming is to be kept below 2 °C, let alone the 1.5 °C needed, weak efficiency standards are not enough. A carbon price and an emissions target are needed to drive absolute emissions cuts, and fast.

Emissions reductions in the shipping sector

The good news is that emissions from shipping can be cut. A recent study found that negative- or low-cost technical measures could reduce emissions by 33 per cent from projected levels in 2020 (ICCT (2011) ‘Reducing Greenhouse Gas Emissions from Ships: Cost Effectiveness of Available Options,’ http://www.theicct.org/pubs/ICCT_GHGfromships_jun2011.pdf). Fuel and other savings mean that most of these reductions are actually profitable, but a range of market barriers holds them back. Huge savings can also be made by changes to operational practices, such as simply reducing ship speeds.

Some of these technical measures may be leveraged through the efficiency standards for new ships recently adopted in the IMO. But important though this step is, it applies only to new ships, and will reduce emissions by barely 1 per cent compared with business-as-usual in 2020 (http://www.transportenvironment.org/News/2011/8/A-first-step-The-IMOs-regulation-of-shipping-emission/).

Pricing emissions or their proxy – fuel – is the next step needed. With the oil price shocks of the 1970s, bunker fuel prices rose from $14 per tonne to almost $200 per tonne within a few years, and large investments in the energy efficiency of ships followed. Fuel consumption and resulting emissions fell after 1973 and throughout the 1980s, only rising again to pre-1973 levels in the early 1990s,despite a substantial increase in the tonnage shipped over that period.

Bunker fuel prices are rising again, and further savings can be expected. But to drive change at the speed demanded by the rapid onset of climate change, and to help overcome market barriers, a further political signal is needed.

Setting a carbon price for ships – even one starting at a moderate level – sends the clearest signal to ship owners and operators that they must internalize their carbon costs in both the designs and operations of their ships. Those that do so first will gain competitive advantages over those slow to act (achieving absolute emissions reductions may also require revenues raised from a carbon price to be used to finance emissions cuts from outside the maritime sector via the GCF).

Principle 2: No net costs for developing countries

A ship and a coal-fired power station may produce equivalent quantities of greenhouse gas,but while it is clear which country is responsible for a power station’s emissions, a ship’s emissions cannot be linked to any one country.A carbon price must, therefore, apply equally to all ships. However, to ensure consistency with the principle that developed countries must lead the fight against climate change (CBDR), developing countries must face no net costs as a result. Each must receive a portion of the revenues raised by the carbon price as a rebate in line with the economic impact incurred.

How to determine costs to developing countries

It is not easy to estimate the impact that a carbon price for international shipping will have on the economies of developing countries. The cost of shipping goods from one place to another (the freight rate) depends on a wide range of factors: including ship type, volume traded, trade imbalances, fuel price, distance travelled, market competition, port infrastructure, and so on.No perfect formula is possible, but a reasonable and workable one can be found. The proposal on the table in the IMO is both reasonable and workable. It assumes that developing countries will be affected principally through higher import costs, and suggests they should therefore receive a portion of the total revenues raised from the carbon price equivalent to their share of global imports by sea.

Costs to importers and exporters

Increased transportation costs may have two direct effects on a country’s economy: an increase in the cost of imports and/or a decrease in the competitiveness of its exports. In the vast majority of cases, it is reasonable to assume that increased transportation costs will be passed on to consumers via higher import costs. Exporters may only be affected in circumstances where there is competition from domestic production or from a country significantly closer to their market. But in general, as various studies have shown, the distance of a voyage is not an overriding determinant of the costs of transporting goods by sea, and will have little effect on the increase in freight rates brought about by a carbon price.

For the poorest countries, whose economies rely heavily on imports, these impacts may be a better measure of the costs to their economies in any case. This is particularly the case for net food-importing countries, where 50 per cent or more of household expenditure is likely to be on food. However, if considered necessary by governments, a workable proposal could make some allowance for the impacts of a carbon price on developing country exports.

Anticipating the scale of costs to developing countries

The costs of a carbon price for shipping are likely to be marginal. A new study for this paper shows that – assuming a carbon price of $25 per tonne, and total emissions from shipping of 1.05 gigatonnes in 2020 – the total cost burden of setting a carbon price for ships would be $26.3 billion. The resulting maximum cost increase in global trade by sea is estimated at less than 0.2 per cent, equivalent to an additional $2 for every $1,000 traded (A. Stochniol, A. (2011b) ‘The expected overall impact on trade from a maritime Market Based-Mechanism (MBM),’ http://imers.org/docs/impact_on_trade.pdf).

This is likely to have a marginal impact on global patterns of trade, not least when seen in the context of much larger changes in bunker fuel prices and freight rates over the past two decades. All of the studies analysed in the report of the IMO Expert Group on addressing greenhouse gas emissions from ships assumed that a carbon price would increase the bunkers price by approximately 10 per cent. This is much less than the fluctuations in fuel prices over the past decade.

| The bunker fuel price has fluctuated by more than 300% in the last five years, so a carbon price that raises fuel prices by around 10% is likely to have a marginal impact on patterns of global trade. |

Efficiencies driven both by rising fuel prices and by a clear political signal to internalize a carbon price will reduce these projected aggregate cost increases over time. Nonetheless, assuming that the costs of the carbon price will be passed on to consumers, it is important to understand the impacts on different countries and different commodities, especially food.

| Estimated impacts on South Africa and Bangladesh A new study for this paper finds that aggregate import cost increases for South Africa and Bangladesh are likely to be less than 0.2 per cent. Using a methodology similar to that employed by the IMO Expert Group on addressing emissions from ships, the study estimates the impact of a carbon price on four major categories of imports – food, fuels, minerals, and manufactured goods – based on 2007 trade patterns.Assuming: • a carbon price that increases bunker fuel prices by 10 per cent; • available estimates of elasticity of freight rates to bunker fuel price for relevant types of ship of between 0.25 and 0.29; • average ad valorem transport costs (transport costs as a proportion of total import value) for different commodities taken from the OECD Maritime Transport Costs (MTC) database; and • 100 per cent of costs are passed on to importers, the estimated increases in import costs are 0.14 per cent for South Africa and 0.19 per cent for Bangladesh. |

The difference is due to the different composition of imports in each country – principally the higher proportion of food imported by Bangladesh compared with South Africa, which has higher shipping costs as a proportion of total value than other products. For both countries, food imports are estimated to rise by 0.3 per cent. This compares with increases over the past 24 months in local maize prices in South Africa of 34 per cent (62 per cent in the past 12 months) and in local rice prices in Bangladesh of 51 per cent (4 per cent in the past 12 months) (FAO GIEWS Food Price Data and Analysis Tool http://www.fao.org/giews/pricetool2/).

A carbon levy of $25 per tonne is likely to increase costs of food imports by 0.3 per cent – for which developing countries must be compensated. This should be compared with the fact that world food prices are likely to double by 2030, with around half the increase driven by the effects of climate change.

Though further studies may be needed to design the details of a scheme, these conclusions, which are consistent with the aggregate impacts estimated by the reports of both the IMO Expert Group and the UN High Level Advisory Group on climate finance, suggest that governments can agree upon the key principles of a global mechanism with confidence that developing countries can be adequately compensated for any economic impacts they incur.

Using rebate revenues to protect the poorest

Although the impacts of a carbon price on ships are likely to be small, the revenues provided to developing countries as rebates should be spent on building the resilience of their most vulnerable citizens, especially women, against the much larger rises and high volatility of commodity prices they are facing. As Table 1 indicates, some developing countries could significantly increase their expenditure on key social protection programmes. Developing countries should be required to report on their use of rebate revenues to ensure that the most vulnerable people benefit.

Estimated rebates for developing countries and potential uses

| Country/social protection programme | Programme budget ($m) | Estimated scale of rebate ($m) | Potential increase in programme budget (%) |

| Ethiopia: Productive Social Safety Net Programme | $360m (2009) | $15m | 4% |

| Kenya: Hunger Safety Net Programme | $140.6m (2008″12) | $23m | 16% |

| Bangladesh: Vulnerable Group Development Programme | $85.5m (2011) | $40m | 46% |

| Philippines: Pantawid Pamilyang Philipino Programme | $28.3m (2011) | $150m | >500% |

Principle 3: Substantial revenues for the green climate fund

The development prospects of poor countries in the 21st century depend on their capacity to adapt to climate change and shift to low-carbon economies. Estimates suggest that this transformation will require public investments in the order of $110 billion”$275 billion per year by 2020. In this light, the commitment by developed countries in Cancun to mobilize $100 billion per year by 2020 is only a starting point for what may eventually be needed. But governments must make a start. A trajectory of scaled-up climate finance is needed from 2013″20, with resources from two primary sources.

Budget contributions by developed countries: Under the UNFCCC, developed countries are responsible for providing climate finance. Only a new commitment to scaled-up budget contributions starting in 2013 can prevent a gap in climate finance flows after the end of the Fast Start Finance period agreed in Copenhagen for 2010″12.

Supplementary sources of public climate finance: While budget contributions should be the main vehicle for raising public funds, they are unlikely alone to guarantee that resources can be scaled up sufficiently. Fast Start Finance is limited in scale, often consists of recycled funds, and is counted towards aid promises by almost everyone, meaning it is only secured by taking aid from other vital areas like health and education. Some countries will struggle to maintain even this commitment in 2011 and 2012.

Supplementary sources of public climate finance, consistent with CBDR, are needed to enhance the scale, additionality, and reliability of revenues. The most promising option in the near term is to raise finance from international shipping.

Scale of revenues from international shipping

Assuming a carbon price of $25 per tonne, and global emissions from the maritime sector of approximately 1 gigatonne in 2020, total revenues generated by a fuel levy or by the auctioning of allowances under an emissions trading scheme would amount to approximately $25 billion in 2020. Assuming that developing countries receive a rebate from this based on their share of global imports by sea, up to 40 per cent of total revenues would be used as compensatory rebates. From the 60 per cent of remaining revenues, a substantial proportion – at least $10 billion – should be directed to the Green Climate Fund. A smaller proportion could remain in the maritime sector to be spent on research and development into cleaner shipping.

Recommendations

In 2011, agreement on the three key principles of a fair global deal for shipping emissions is needed in the G20, IMO, and UNFCCC.

• The World Bank/IMF report to G20 finance ministers on sources of climate finance should assess in depth a carbon price for international shipping, including its likely effects on, and options to compensate, developing countries.

• G20 finance ministers should reach a political agreement that substantial climate finance should be raised through a carbon price for international shipping, with no net costs for developing countries.

• The IMO Assembly in November 2011 should pass a resolution confirming the need for a carbon price for shipping emissions.

• Governments at COP17 in Durban should urge the IMO to act, giving guidance on the need to ensure that a carbon price achieves meaningful mitigation and applies to all ships, with revenues used to ensure that there are no net costs for developing countries and substantial new resources for the Green Climate Fund.

NOTE: ‘The material in this article is adapted by the publisher from Out of the Bunker, 2011, with the permission of Oxfam GB, Oxfam House, John Smith Drive, Cowley, Oxford OX4 2JY UK www.oxfam.org.uk Oxfam GB does not necessarily endorse any text or activities that accompany the materials, nor has it approved the adapted text.’

The complete and original report can be accessed here: http://policy-practice.oxfam.org.uk/publications/out-of-the-bunker-time-for-a-fair-deal-on-shipping-emissions-141889

Photo credit: Roberto Venturini/Getty